The industry benchmark for Structured Finance, Securitization and Asset Finance Software as a Service

An evolutionary approach involving best in class software that addresses the key risk and regulatory requirements needed by the various industry participants

Trusted by the world’s leading financial institutions

Flexible Software

- Supporting complex regulatory requirements

- Automation of workflow activities

- Dealing with increased cyber security and operational risks

- Generating material operational efficiencies - better results within shorter timeframes

- Effectively managing both internal and external stakeholders

- Establishing industry best practices throughout the transaction lifecycle

- Multiple deployments - hosted and installed on-premises

- Lowering costs - sound ROI and whole of life ownership benefits

Adressing Complex Regulatory and Risk Requirements

Remaining at the forefront of regulatory and risk requirements is of paramount importance to our customers. TAO provides its customers with peace of mind that the necessary regulatory and risk requirements can be effected within the timely manner that is successfully deployed to its customer base. Examples include:

- SOFR, SONIA, AONIA etc interest rate benchmark requirements

- New ESG and climate risk assessment and reporting requirements

- Data security, privacy and overall data management protocols

- Automated regulatory reporting including data validation needs

- Best practices in terms of operational risk management and audit logs

- Multi-jurisdictional reporting, SEC, ESMA, Bank of England, Reserve Bank of Australia, Reserve Bank of New Zealand capabilities

- Automated rating agency feeds for new issuance and on-going surveillance needs

Automation of Workflow Activities

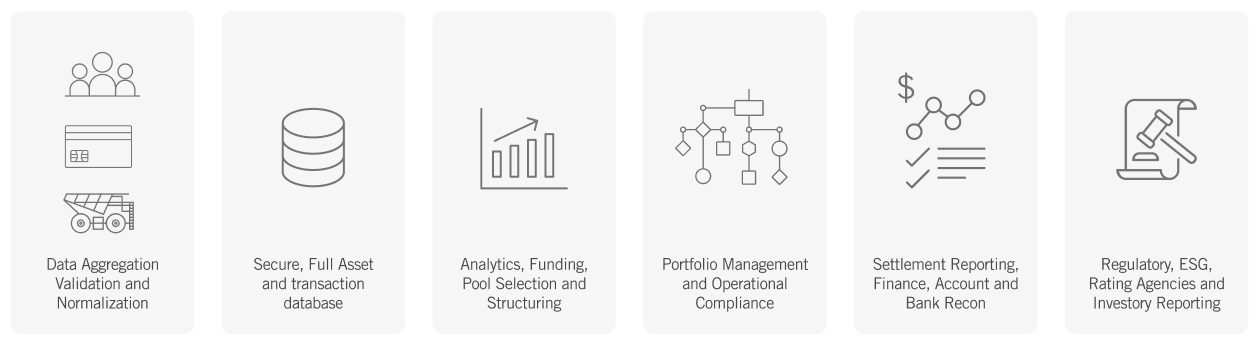

Automating lengthy manual processes to optimally interact with all available data, every feature has been crafted to meet the growing needs of the financial services industry in the evolving digital age.

- Advanced data ingestion and normalized table structuring

- In-built analytics and dashboards to analyze data, simplify work-flows and support reporting needs

- Optimize new originations involving multiple funding vehicles whilst confirming compliance with eligibility criteria and portfolio parameters

- Enhanced transaction structuring and modeling capabilities that do not require SQL knowledge

- Flexible reporting for both internal and external stakeholders

- Inbound files to obtain ESG, climate impact information, market rates and property information

- Outbound files to key stakeholders such as regulators, rating agencies, data repositories, investors and trustees

- Accounting, payment instructions and bank reconciliations

- Required audit and controls mechanisms

Introducing Material Operational Efficiencies, Reducing Operational Risk, Supporting Remote Access and Audit & Risk Requirements

TAO software enables customers that have been impacted with qualified staff shortages the ability to control and automate operational tasks without the need to increase headcount. Specific processes can be undertaken and reviewed and approved via our enterprise solution with audit logs of activities undertaken and approvals provided.

Remote access, concurrent multi-user access can also be accommodated thereby supporting an organization's revised working arrangements to retain qualified staff.

Contact Us

By submitting this form, I agree to receive communications from TAO in connection with my inquiry. My information will be processed in accordance with TAO's Privacy Policy.