The industry benchmark for Structured Finance, Securitization and ESG Software as a Service

An evolutionary approach involving best in class software that addresses the key risk and regulatory requirements needed by the global financial services industry

SecureHub

- Supporting complex regulatory requirements

- Automation of workflow activities

- Dealing with increased cyber security and operational risks

- Generating material operational efficiencies - better results within shorter timeframes

- Effectively managing both internal and external stakeholders

- Establishing industry best practices throughout the transaction lifecycle

- Multiple deployments - hosted and installed on-premises

- Lowering costs - sound ROI and whole of life ownership benefits

Supporting Complex Regulatory Requirements

Remaining at the forefront of regulatory requirements is of paramount importance to our customers. TAO provides its customers with peace of mind that the necessary regulatory changes can be effected within a timely manner that is successfully deployed to its customer base. Examples include:

- SOFR, SONIA, AONIA, etc. RFR interest rate benchmark requirements

- New ESG and climate risk assessment and reporting requirements

- Data security, privacy and overall data management protocols

- Automated regulatory reporting including data validation needs

- Best practices in terms of operational risk management and cyber security

- Multi-jurisdictional reporting, SEC, ESMA, Bank of England, RBA, RBNA capabilities

- Automated rating agency feeds for new issuance and on-going surveillance needs

Automation of Workflow Activities

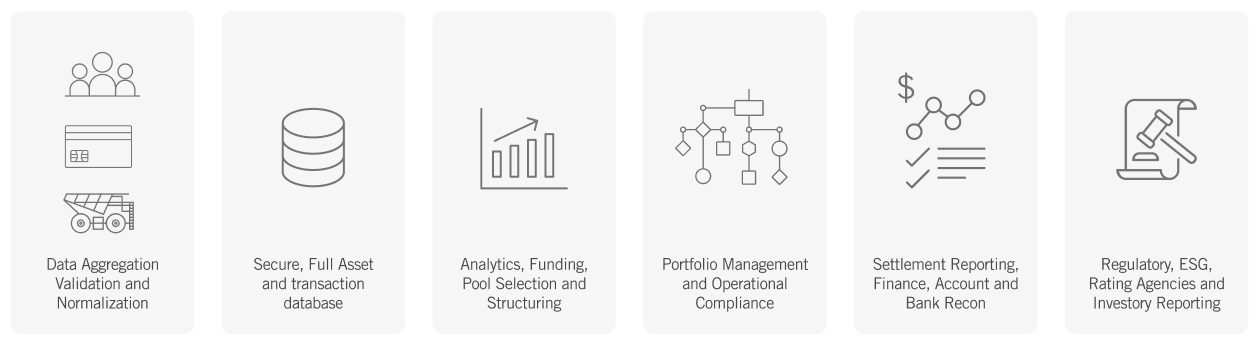

Automating lengthy manual processes to optimally interact with all available data including ESG, every feature has been crafted to meet the growing needs of the financial services industry in the evolving digital age.

- Advanced data ingestion and normalized table structuring

- In-built analytics and dashboards to analyze data and support reporting needs

- Optimize new originations involving multiple funding vehicles whilst confirming compliance with eligibility criteria and portfolio parameters

- Enhanced transaction structuring and modeling capabilities that do not require SQL knowledge

- Flexible reporting for both internal and external stakeholders

- Inbound files and APIs to obtain ESG, climate impact information, market rates and property information

- Outbound files to key stakeholders such as regulators, rating agencies, trustees

- Accounting, payment instructions and bank reconciliations

- Required audit and controls mechanisms

Introducing Material Operational Efficiencies, Reducing Operational Risk, Supporting Remote Work and Audit & Risk Requirements

TAO software enables customers that have been impacted with qualified staff shortages the ability to control and automate operational tasks without the need to increase headcount and subject matter expertise. Specific processes can be undertaken and reviewed and approved via our enterprise solution with audit logs of activities undertaken and approvals provided.

Remote access and concurrent multi-user access can also be accommodated thereby supporting an organization's revised working arrangements to retain qualified staff.

-

Extensive Data and Detailed Analytics For Superior Insights and Control

- Designed to house an unlimited number of data points, SecureHub is scalable both horizontally and vertically

- Perform detailed analytics to obtain precise asset-level information (both current and historical)

- Effectively manage ad-hoc and new regulatory, investor, management and stakeholder information and reporting requests

- Generate key performance indicators from precise datasets updated in real-time

- Create customized dashboards with detailed analytics to support your specific needs

- Generate high-quality graphs and charts for easier review and reporting

-

Execution Agility to Save You Time

Automated asset selection, pool modelling, eligibility checks, and concentration analysis will reduce your costs while improving accuracy.

SecureHub delivers on the promise of true automation for asset selection and portfolio optimization by employing its own algorithmic engine (Opti-Pool) to intelligently select eligible assets and optimize them for concentration limit program constraint parameters in seconds.

-

Automated Funding

Loans are selected to funding vehicles based upon customer’s requirements taking into consideration eligibility criteria, portfolio parameters and covenants. Thereafter, funding notices are provided in the format required by lenders.

Automated funding of top-up, drawdown processing and reporting requirements to support each funder across a range of reporting templates, asset schedules, and other key requirements.

-

Lower Your Risk With Exacting, Repeatable Administrative Processing

Mitigate risk and lower costs by putting the power of administration processing into your hands through SecureHub’s powerful, formula-based calculation engines

Waterfall logic is continuously validated, locked-down, and audited to ensure error-free and repeatable processes

Previously defined waterfalls and logic can be copied making it fast and efficient to set up new programs

Once locked down, ongoing audits are simplified as SecureHub produces detailed audit reports of subsequent changes and bank reconciliations

-

Keep Stakeholders Informed on Your Own Terms

Create and maintain multiple reports for each stage of the structured finance lifecycle to enjoy a best-in-class user experience and the flexibility to meet ongoing demands

The unique Excel® plug-in tool allows you to create and maintain multiple reports for each stage of the structured finance lifecycle

Interactive dashboards use real-time data with a powerful built-in ad-hoc analytics and reporting toolset that help you uncover key insights

Regulatory and rating agency reporting and extracts, for both program aggregates and asset-level disclosures, is made simple for multiple jurisdictions and formats as a part of SecureHub’s embedded functionality

-

Simplifying Your IT Infrastructure

With the TAO cloud, we manage all aspects of IT infrastructure, including application deployment, maintenance, business continuity and deployment upgrades, all while lowering the total cost of ownership.

With TAO Solution’s SOC 2 Type 2 accreditation and embedded security and control procedures, SecureHub supports the most stringent requirements of the financial services industry and regulators

Cloud-hosted instances of SecureHub are located within domestically located-cloud data centres with the highest levels of operational excellence and certifications

Contact Us

We will get back to you as soon as possible.

Please try again later.

By submitting this form, I agree to receive communications from TAO Solutions in connection with my inquiry. My information will be processed in accordance with TAO Solutions Privacy Policy.

Products

Solutions

©2024 TAO Solutions

Terms & Conditions | Privacy Policy | SOC 2 | ISO | Gold MS Partner